From 1 April 2024, workers aged 21 and over will be entitled to the National Living Wage. The NMW for 2024/25 is as below: Age 2024/25 Workers aged 21 and over £11.44 per hour 18 to 20 year olds £8.60 per hour under 18 year olds £6.40 per hour Apprentice […]

News

From the tax year 2023-24 onwards, the Self Assessment threshold for taxpayers taxed through PAYE only, will change from £100,000 to £150,000. Affected taxpayers will receive a Self Assessment exit letter if they submit a 2022-23 return showing income between £100,000 and £150,000 taxed through PAYE and they do not […]

The National Minimum Wage (NMW) is the legal minimum hourly wage that most workers in the United Kingdom are entitled to. It is set by the government and reviewed every year. The NMW for 2023/24 is as below: Age 2023/24 Workers aged 23 and over £10.42 per hour 21 to […]

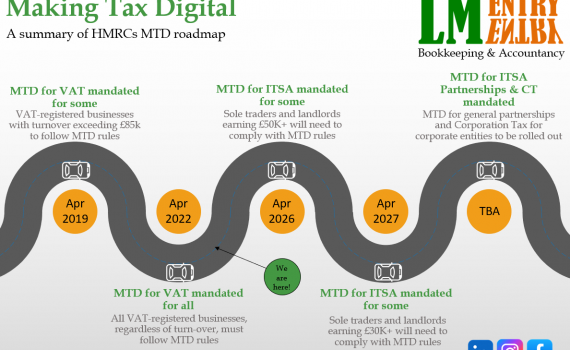

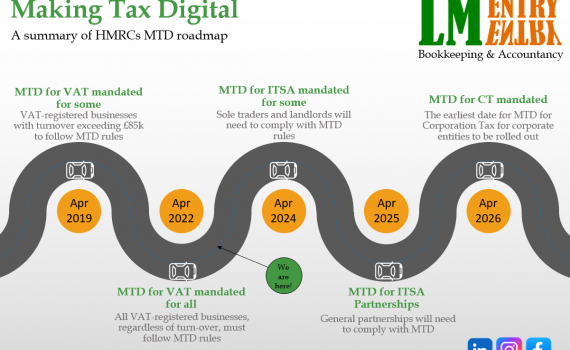

The government has announced a two-year delay to the introduction of Making Tax Digital for Income Tax Self Assessment (MTD for ITSA), along with major changes to the income thresholds for those affected. MTD for ITSA had previously been scheduled to start in April 2024, and self-employed business owners and […]

The November 2022 UK autumn statement was delivered to the House of Commons on 17 November 2022 by Chancellor of the Exchequer Jeremy Hunt, after being delayed by three weeks from its original scheduled date of 31 October. Here are some of the key takeaways for small businesses and landlords:

If you are self-employed, a sole trader or landlord currently reporting taxable income of £10,000 or more in a tax year through Self Assessment, you will need to inform HMRC of your business income and expenses via quarterly updates from 6th April 2024. This will replace the annual Self Assessment […]

The U-Turn Following the mini-Budget on 23rd September, an unprecedented U-turn on some of the measures that had been announced was confirmed on Monday by new Chancellor Jeremy Hunt. We’ll summarise the impact that Monday’s announcement had on the measures that affected small business clients in the mini-Budget: · IR35 […]

How it impacts small businesses The Chancellor, Kwasi Kwarteng, unveiled major changes to tax and National Insurance in Friday’s mini-Budget Here are the highlights for small businesses: • National Insurance rate increase will be reversed in November • Corporation Tax will remain at 19% • IR35 to be simplified with […]

Basingstoke, UK – September, 2022: LMEntry Ltd, your reliable & local Accountancy & Bookkeeping partner, announces they will be exhibiting on Stand #15 at Basingstoke Business Expo held at Oakley Hall Hotel on Thursday 15th September 2022. With challenges to business growing every day, business owners need to focus on […]