From 1 April 2024, workers aged 21 and over will be entitled to the National Living Wage. The NMW for 2024/25 is as below: Age 2024/25 Workers aged 21 and over £11.44 per hour 18 to 20 year olds £8.60 per hour under 18 year olds £6.40 per hour Apprentice […]

Lorna Mentias

Although the deadline to submit and pay your 2023-24 tax bill is January 31st 2025, we strongly advise to aim to have it submitted long before then. This will give you ample time to prepare for the payment and avoid any last-minute rush or penalties for late payment. Filing your […]

At LMEntry Ltd, we’ve got a tech-savvy side that makes managing your accounts a breeze! We opt to use cloud accounting software to prepare your accounts, and we have a soft spot for two awesome platforms: FreeAgent and QuickBooks. Why do we love cloud accounting, you ask? Well, it’s like […]

We specialise in partnering with sole traders, landlords, and small to medium-sized businesses, and we do it with a friendly and welcoming approach. We understand that these types of businesses have unique needs and challenges, and we’re here to support you every step of the way. As a sole trader, […]

Ultimately, the decision to partner with LMEntry Ltd lies with you. We offer a complimentary ‘discovery call’ where you talk about yourself, your business and explain the areas of accounting that you’d like assistance with, as well as your longer-term plans for your business. If you feel we are the […]

At LMEntry, ‘transparency’ isn’t just a buzzword – it’s one of our Core Values that guides our business practices. We believe in fostering strong relationships built on trust, honesty, and open communication. As a testament to our commitment, we’ve prepared a step-by-step guide that outlines what you can expect as […]

We believe in providing personalised solutions that meet your specific accounting requirements. That’s why we offer a no-obligation discovery call, where we can have a friendly chat to understand your business and its unique needs. This call allows us to get to know each other better and determine how we […]

From the tax year 2023-24 onwards, the Self Assessment threshold for taxpayers taxed through PAYE only, will change from £100,000 to £150,000. Affected taxpayers will receive a Self Assessment exit letter if they submit a 2022-23 return showing income between £100,000 and £150,000 taxed through PAYE and they do not […]

The National Minimum Wage (NMW) is the legal minimum hourly wage that most workers in the United Kingdom are entitled to. It is set by the government and reviewed every year. The NMW for 2023/24 is as below: Age 2023/24 Workers aged 23 and over £10.42 per hour 21 to […]

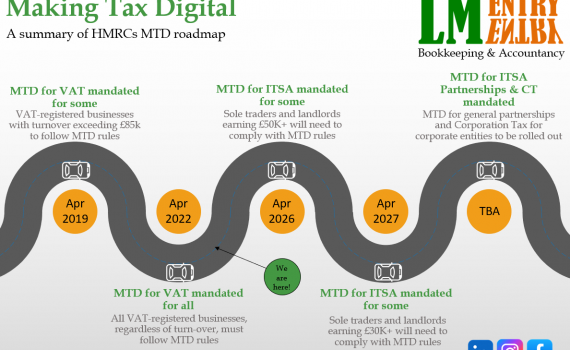

The government has announced a two-year delay to the introduction of Making Tax Digital for Income Tax Self Assessment (MTD for ITSA), along with major changes to the income thresholds for those affected. MTD for ITSA had previously been scheduled to start in April 2024, and self-employed business owners and […]