If you are self-employed, a sole trader or landlord currently reporting taxable income of £10,000 or more in a tax year through Self Assessment, you will need to inform HMRC of your business income and expenses via quarterly updates from 6th April 2024. This will replace the annual Self Assessment return as we know it.

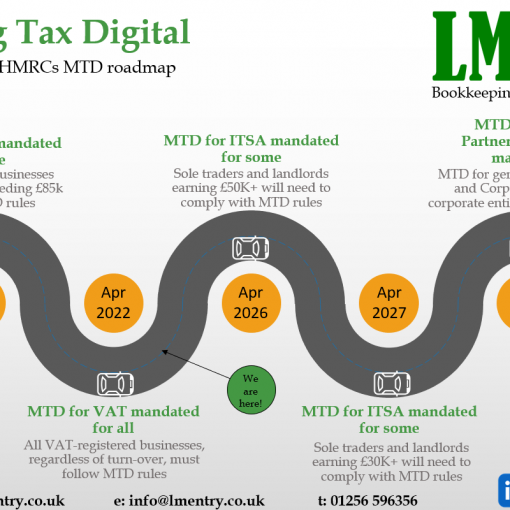

Making Tax Digital (MTD) is a fundamental change by HMRC that will digitise the UK tax system for users and started by targeting VAT-registered businesses exceeding the VAT threshold back April 2019. From April 2022, all VAT registered businesses must submit their returns via MTD-compatible software. Next on their agenda is MTD for the Self-Employed.

MTD will help people and businesses to manage their business records more efficiently whilst also preventing basic tax errors, which cost the UK billions of pounds a year in lost tax revenue.

MTD FOR ITSA IN MORE DETAIL

As mentioned, quarterly income and expenditure updates will have to be submitted meaning the affected will no longer be required to file a Self Assessment tax return each year.

You will have to maintain digital records of your business affairs and send digital quarterly summaries to HMRC using MTD-compatible software.

In complying with MTD for ITSA, you will be in a better position to budget for tax liabilities based on the figures you send each quarter. At the end of the tax year, you’ll need to make an end of period statement (EOPS) confirming the figures you’ve submitted, once any accounting adjustments have been made. Submitting your final declaration is the last step, at which point HMRC will confirm how much tax you owe for that tax year.

If it’s not practical for you to use software to keep digital records or submit data to HMRC digitally, because of your age, disability, location (ie poor internet connection) or other justifiable reason (which can include religion), you can apply for MTD for ITSA exemption . If this is accepted, HMRC will provide you with an alternative solution.

If you don’t apply for exemption and fail to comply with MTD for ITSA rules, this may result in penalties.

WHEN IS IT COMPULSORY FOR ME TO SIGN UP TO MTD FOR ITSA?

MTD for ITSA is being introduced on 6 April 2024, so you have plenty of time to get the necessary software and sign up. You may be able to join the MTD for ITSA pilot scheme now if:

- You are a UK resident who is already registered for Self Assessment

- Your accounting period aligns with the UK tax year (6th April to 5th April)

- You have submitted at least one Self Assessment tax return previously

- You are already keeping digital records

- Your tax records are up to date with no outstanding tax bills

- You have income from one source of self-employment, including landlords (except those with furnished holiday lettings)

WHEN ARE THE QUARTERLY DEADLINES FOR REPORTING MTD FOR ITSA TO HMRC?

You (or your authorised tax agent) will need to send a summary of your income and expenses online to HMRC at the end of each quarter. You’ll get up to a month after the end of each quarter to do this. The standard quarterly periods and deadlines in each UK tax year are:

| Quarterly period | Quarterly submission deadline |

|---|---|

| 6 April to 5 July | 5 August |

| 6 July to 5 October | 5 November |

| 6 October to 5 January | 5 February |

| 6 January to 5 April | 5 May |

As with the current system, late submissions or payments under MTD for ITSA may result in penalties.

WHEN DO I HAVE TO PAY MY MTD FOR ITSA TAX BILL?

As with the current payment deadline, you must pay your MTD for ITSA tax bill on or before 31st January in the following tax year. For the 2024/25 tax year, you must pay your tax bill on or before 31st January 2026.

One thought on “Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) to be made mandatory for the Self-Employed from 6th April 2024”